Terms & Conditions

1.

Introduction

These terms and conditions (“terms”) apply to all users of our website and app and to customers referred to us from third-party services. Please read them carefully. If you don’t accept them, please don’t use our services.

We may update these terms from time to time. Any updates will be posted to this page, so please check back frequently. If you continue to use our services after the update you will be considered to have accepted the new terms and they will apply to you.

You should also read our Privacy Notice and Cookies Policy carefully before you decide to use our services.

As of 27th October 2023 the TotallyMoney debit card is closed to new customers. If you were a TotallyMoney debit card customer, you should read the separate terms and conditions for the TotallyMoney debit card, which can be found here.

2.

Who we are

We are TotallyMoney Limited. We own and operate the free credit report and personalised consumer credit website, www.totallymoney.com, and the TotallyMoney app. We provide a range of services to help you better understand and improve your financial situation.

Depending on which of our services you use, we may act as an independent credit broker or insurance intermediary. We are not a lender or an insurance provider.

TotallyMoney Limited is a company registered in England (No. 06205695), with VAT number 974859255. Our registered office address is White Collar Factory, 1 Old Street Yard, London, EC1Y 2AS.

TotallyMoney Limited is an Appointed Representative of TM Connect Limited, which is registered in England and Wales (Company Registration Number 06967012, FCA FRN 511936). TM Connect Limited is authorised and regulated by the Financial Conduct Authority in respect of:

Credit broking

Providing credit information services

Mortgage arranging

Insurance mediation activity

TotallyMoney Limited is also a registered agent of Bud Financial Limited (“Bud”), our open banking partner. Bud is registered in England and Wales (Company Registration Number 09651629, FCA FRN 793327). Bud is authorised and regulated by the Financial Conduct Authority in respect of payment services. For more information about our open banking services, please see section 3.10 below.

You can check the Financial Services Register by visiting the FCA website.

We also provide an energy comparison and switching service, which is not an FCA regulated activity.

3.

Our services

3.1.

Free of charge

Unless otherwise stated, all of the services described in these terms and conditions are totally free. You don’t have to apply for any of the products we offer (“products”) to use our services, and we don’t sell your data or charge third parties for access to it. Instead, the partners that we work with such as credit issuers, credit brokers or other service providers (referred to in these terms as “partners”) pay us a commission if you take out a new product with them.

3.2.

Registering for a TotallyMoney account

You need to create an account with us to access the full range of our services, including:

access to a free credit report and credit score service (our “credit report service”);

tailored information about your borrowing power and eligibility for products (your “Borrowing Power”);

services powered by open banking data (e.g. showing you your balance after bills);

energy comparison and switching; and

car insurance comparison.

When you register, you must give us true, accurate, current and complete information about yourself. The results we show you are based mainly on the information you provide. If you don’t keep your information up to date, your results are likely to be less accurate. We recommend that you update your account information regularly, and as soon as possible if something important changes (e.g. your address or income or outgoings). You can update your information in the “My Details” section of your TotallyMoney account, and we’ll sometimes give you a nudge to do so when you log in. If you are not sure how to amend your information, please email us – [email protected].

3.3.

Your Borrowing Power

Your Borrowing Power is a score out of ten, which gives you an idea of the credit you may be able to access. If we have enough information to calculate your Borrowing Power, we calculate it:

at the time you first register for an account with us;

whenever you log in to our website or app;

when you check your eligibility for credit cards or loans; and

at least once a month while your account is live, to let you know if your Borrowing Power is changing.

We’ll show you your current Borrowing Power in your account. We’ll also send you service emails to tell you about any changes to your Borrowing Power. If push notifications are enabled on your device, we may send you service messages by push notification. We’ll use your Borrowing Power to show you tailored information about products that might be available to you. See Tailored Offers below for more information about this. We reserve the right to stop calculating your Borrowing Power on a regular basis if your account is inactive for 12 months or more.

3.4.

Your credit report and credit score

3.4.1. Our relationship with the credit reference agencies

We work together with credit reference agencies to make our services available to you. A credit reference agency is a company that collects personal information from various sources and provides that personal information to banks and financial institutions to help them make credit decisions. A credit report shows you the information that a credit reference agency holds about you. We have appointed:

Experian Limited ("Experian") to conduct pre-screening searches and eligibility checking; and

TransUnion International UK Limited (“TransUnion”) to supply credit reports and scoring for the credit report service.

We also work with Equifax Limited and its group companies (“Equifax”). This is because some loan lenders that TotallyMoney works with use Equifax to help them to process, understand and/or make decisions based on your open banking data.

The partners we work with may also use credit reference agencies when they assess your eligibility.

For details of how we share your personal data with Experian, Equifax and TransUnion, see our Privacy Notice.

3.4.2. Powered by TransUnion

Our credit report service is powered by TransUnion. This means that we share some of the personal information you give us with TransUnion and its subcontractors so that they can search their own and third-party databases to find information they hold about you. We can then tell you whether TransUnion is able to provide you with a credit report through TotallyMoney.

When we check whether TransUnion is able to provide you with a credit report and when we retrieve your credit report and credit score from TransUnion, we are making a subject access request under Article 15 of the UK GDPR to TransUnion, on your behalf.

By creating an account with us:

you appoint us to act as your agent and representative in accessing and retrieving your credit report and credit score on an ongoing basis, for as long as your TotallyMoney account is open, from TransUnion as a credit reference agency;

TransUnion as a credit reference agency shall be entitled to rely on this agency and related authorisation granted by you to us;

you instruct us, on an ongoing basis without needing your further express permission, to submit (as your agent) a request for access to your credit history information to TransUnion, in accordance with your statutory rights under data protection legislation, for the purpose of providing our services to you.

For details of how we use your credit report data and credit score data, see our Privacy Notice.

3.4.3. Authenticating you for a credit report

When you sign up for a TotallyMoney account, we’ll use your account data to prevent and detect crime, including fraud, money laundering and funding terrorism via fraud detection agencies. TransUnion use this data to check whether it is able to provide you with a free credit report and credit score. When TransUnion are going to do this check, we will make it clear to you in the sign-up terms that are shown to you before you create your account.

You will need to successfully pass these authentication processes before we can show you your credit report and credit score. You may not successfully pass authentication. This may be because:

You may not successfully pass authentication. This may be because:

TransUnion is not able to match your personal information to the correct credit report; or

TransUnion doesn’t hold enough credit information on you to create a credit report; or

you do not pass all fraud checks.

TotallyMoney and TransUnion are not required to tell you why you haven’t been successfully authenticated, whatever the reason.

3.4.4. Updates to your credit report and credit score

If you pass the authentication process (as above) and we are able to provide you with your free credit report and credit score, we’ll show you your credit report and credit score in your account.

We may also ask for your updated credit report data and credit score data each month from TransUnion whilst your account is live. Each time you login we’ll update your credit score and only update your credit report, if our data suggests there’s been a change with TransUnion, or if it’s been more than a week since your last report update. We’ll send you service emails as a reminder that we have got your credit report and score data from TransUnion. If push notifications are enabled on your device, we may send you service messages by push notification. We reserve the right to stop updating your credit report and credit score on a regular basis if your account is inactive for 12 months or more.

We use your credit report data to personalise and improve the service. For more details, see our Privacy Notice.

3.4.5. Incorrect information in your credit report

It is TransUnion, not us, who coordinates making changes to credit report data. If you wish to dispute the accuracy of anything shown in your credit report, please use the “raise a dispute” buttons in the “My Credit Report” area of your account to raise a dispute directly with TransUnion. If you have any questions about your credit report, please contact us in the first instance.

3.4.6. What happens if we can’t find your credit history

We can’t guarantee that we’ll be able to provide your free credit report or credit score. This is because you might not be found by the credit reference agencies or partners that we work with - for example, if you are new to the UK, or have a very limited credit history. In those cases, we’ll show you information that could help you to understand how to improve your chances of being found in future.

3.5.

Tailored offers

3.5.1 Product offers

We’ll show you credit cards, loans, mortgages and other products for consumers.

Your results for credit products are based on our “Match Factor” algorithm, which considers factors such as:

your credit profile;

your eligibility score;

the features of the products; and

the general accuracy of the lender's eligibility scores.

We sort your offers based on their features and the information that you have provided. Although we may be paid commission, this never influences how your offers are ranked.

3.5.2. Eligibility checks

We check your eligibility for products. We contact Experian and certain partners (who in turn may contact credit reference agencies). They use the information you provide to analyse your eligibility for products using their databases and their knowledge of the acceptance criteria for products (“eligibility checks”). An eligibility check isn’t an application for credit, and it won’t harm your credit rating. By checking your eligibility for a product on our website or app, you are not committing to make an application for that product. If you want to apply for a product you find on our website or app, we’ll pass you through to the relevant partner.

3.5.3. Our relationship with partners

We work with partners to present their products and related offers to you, and to allow you to apply for products on the partners’ websites.

Not all partners featured on our website and app provide eligibility information, so you might see products listed that have no information about your likelihood of being accepted for them. Even if your tailored results indicate that you are likely to be accepted for a product, this is not a guarantee that you will be accepted. The partner is entirely responsible for deciding whether to accept you, using its own acceptance criteria. The exception is where we indicate that you are “pre-approved” for a credit product (e.g. for a credit card or loan). In those cases you are definitely eligible for the product, but your application is still subject to passing the relevant lender or credit broker’s checks, for example fraud, ID, vehicle checks and responsible lending checks (which may include a check using open banking). See Pre-approval below for more information about this.

3.5.4. We’ll pre-populate partner application forms for you

If you click to apply for a certain product, we sometimes pass your information to that partner to pre-populate the application form and to make the process quicker for you.

3.5.5. What happens if you are an existing customer of a partner

When a partner assesses your eligibility for products, the partner may also tell us if you are an existing customer of theirs. This is because being an existing customer might influence your eligibility for additional products from the same partner. Being an existing customer could reduce your eligibility for additional products from that partner, or it might mean that you are pre-selected to see additional offers. It depends on the partner’s policies.

3.5.6. What partners tell us about your application

If you leave our website and app to apply for a product with a partner, the partner may give us information about your application. For example, they may tell us:

Whether you completed your application; and

Whether your application was successful, referred or declined.

If you give the partner additional information as part of your application, the partner may share that information with us, where relevant.

We use the information that partners give us to:

calculate the commissions that we are due;

to personalise the service to you;

to send you service messages (for example, if an energy supplier declines your application to switch, we will email you to tell you why, and what to do next);

to help us understand our customers, to improve our service and to inform our marketing strategy (i.e. research and development).

3.5.7. Third party brokers

Some products may need specialist expertise (e.g. certain types of secured loans, mortgages and car finance). If you tell us that you are interested in those products, we’ll introduce you to a specialist credit broker. Look out for notices on our website and app that tell you when we are going to pass your information to another credit broker, as they may contact you to follow up on your enquiry. If you choose to work with another credit broker, you will then be bound by their terms and conditions and privacy policy.

The specialist credit brokers we currently work with are:

Scroll

|

Credit broker |

Products |

|

Aspire Money Limited (Everyday Loans) |

Loans |

|

Monevo Limited trading as Monevo |

Loans |

|

Believe Money |

Loans and secured loans |

|

Ocean Finance |

Secured loans |

|

London & Country |

Mortgages |

|

Evolution Funding Limited trading as My Car Credit NB Evolution acts on behalf of a number of specialist lenders, including Paragon Car Finance, Moneybarn and Evolution Loans Ltd. |

Car finance |

|

Zuto Limited trading as Zuto NB Zuto acts on behalf of a number of specialist lenders, including Autolend, Moneybarn, MoneyWay and Zuto loans. See their Privacy Notice for more details. |

Car finance |

|

247 Money Group Limited and CarFinance 247 trading as Car Finance 247 |

Car finance |

|

CarMoney Limited Trading as CarMoney |

Car finance |

|

Match Me Car Finance Ltd trading as Match Me Car Finance |

Car finance |

|

LUV Financial Solutions as Luv Car Loans |

Car finance |

From time to time we may test different mortgage and loan brokers, but will we always make it clear who we are introducing you to.

We may tell you that you are ‘pre-approved’ or that you have ‘100% chance of acceptance’ for a credit product. These are general terms used by lenders and eligibility checking services to show that, based on the information you have provided, you are eligible for a credit product. But it is never a guarantee that you will get the credit product if you apply, because all applications remain subject to the relevant partner’s own checks, for example fraud, ID, vehicle checks and responsible lending checks (which may include a check using open banking). Your application may still be rejected.

When we say you are ‘pre-approved’ or that you have ‘100% chance of acceptance’, it means that:

you are eligible for the relevant credit product at the headline rates and terms advertised;

provided that the information you provided to us is correct and accurate, and

provided that you pass the lender or credit broker’s own checks.

As part of these checks, some lenders may require you to give your consent to allow access to your financial information via open banking integrations with your bank or building society. A lender may decline a pre-approved application due to ‘responsible lending’ reasons if your financial information indicates that you show signs of vulnerability.

We include notices throughout our website and app to explain what pre-approved means in the context of the particular product.

3.6.

Energy comparison and switching service

Our energy comparison and switching service is powered by Decision Technologies Limited, a company registered in England & Wales under company number 05341159 with its registered address at First Floor, High Holborn House 52-54 High Holborn London WC1V 6RL (“Decision Tech”).

Decision Tech:

provides us with information to help you complete your energy profile (for example, your meter numbers);

tells us what energy tariffs are available to you, so that we can show you your energy results;

hosts and processes your application to switch;

helps us to answer customer queries about our energy comparison and switching service;

tells us whether your switch was completed.

For more information about Decision Tech’s services, please read their Terms and Conditions.

We sort the energy tariffs we show you based on price, plus any filter you’ve applied. For example, you can choose to filter tariffs so that you only see fixed tariffs or tariffs from the ‘big six’ suppliers. Although we are paid a commission if you switch energy supplier, this commission never influences how your tariffs are ranked.

If you choose to switch energy suppliers, the energy supplier you are switching to will provide you with the terms and conditions for your new energy tariff. The energy supplier will also carry out their own security and credit checks. Any full credit check carried out by an energy supplier (also known as a ‘hard’ search) will be visible on your credit file to all lenders in the future.

3.7.

Car insurance comparison service

We partner with Seopa Ltd (“Seopa”), trading as Quotezone, to provide you with a car insurance comparison service. Seopa pays us a commission for any insurance policy you take out through Seopa. Seopa in turn receives a commission directly from the insurer that you took out your policy out with.

Seopa is a company registered in Northern Ireland, under registered company number: NI046322. Seopa’s registered address is 5th Floor Link Building, Adelaide Exchange, 24-26 Adelaide Street, Belfast, BT2 8GD. Seopa is authorised and regulated by the Financial Conduct Authority in respect of insurance mediation activity (FCA FRN: 313860).

When you use our car insurance comparison service, we are acting independently and do not act on behalf of the insurance providers.

Seopa is also acting as an insurance intermediary in its own right, and provides various elements of the service. For example, Seopa:

gives us an estimated cost of insurance, so that we can show that to you on our website or app;

hosts and manages the full quote form that you need to complete to get full quotes;

requests quotes for you from its panel of car insurance providers;

shows you your quotes;

gives us details of your quotes, so that we can send you a record of the quotes you received;

shares information from your quote form and about your application with us (for example, whether your application was successful). See What partners tell us about your application above for more details of how we use that information.

For more information about Seopa’s services, please read their Terms and Conditions.

If you request quotes from Seopa’s panel of insurers, those insurers may run a ‘soft’ search on you, in order to generate quotes. A soft search is like a quick peek at your credit file. Soft searches will not harm your credit rating or affect the way lenders see you. For more information on soft searches, see Soft searches and ‘footprints’ on your credit file below.

If you choose to take out insurance through Seopa, the insurer you are applying to will provide you with the terms and conditions for your new insurance policy. The insurer may also carry out their own security and credit checks. Any full credit check carried out by an insurer (also known as a ‘hard’ search) will be visible on your credit file to all lenders in the future.

It’s your responsibility to ensure that the information you have provided in order to generate your quotes are correct. You’re responsible for answering all questions honestly, completely and to the best of your knowledge, so please double-check your information before submitting it. Failure to do so could invalidate the insurance product that you take out. If your insurance product is invalid, claims may not be paid, and you could be responsible for any third party costs if any event occurs where you would otherwise have been covered by the insurance product.

Before you obtain any insurance product from a provider, you must check all of the information, content, material or data the provider holds about you to ensure it is correct, complete, accurate and not misleading and that you have disclosed all relevant facts. It is important that you read all insurance documents issued to you and ensure that you are aware of the cover, limits and other terms that apply. Failure to comply with the insurer’s terms and conditions could invalidate your policy.

Where you provide information about any other individual (e.g. a named driver) you are confirming that you have their authority to do so.

We do not advise on the suitability of any insurance product and so you should always check the suitability, adequacy and appropriateness of the insurance product that is of interest to you. It is your responsibility to satisfy yourself that you wish to obtain any insurance product before applying for it.

3.8.

What happens when you apply for a product?

We can’t influence partner decisions about you. If you want to apply for a product, you can do so by following the link from the website or app to the relevant partner’s website.

We don’t control the partner’s website, so we can’t be responsible for any personal data that the partner collects, stores and uses through their website without our involvement. You should always read the privacy notice of each website you visit carefully and before you submit any personal data to the partner.

If you apply, you will then be subject to the relevant partner’s terms, including its privacy notice. The partner will provide you with the terms for that product. The partner will also carry out its own identification and validation checks (including fraud prevention procedures) and credit application checks in accordance with its own criteria. In the case of car finance, your application may also be subject to car checks.

Any full credit check carried out by any partner (also known as a ‘hard search’) will be visible on your credit file to all lenders in the future.

Any application for a Capital One product will be subject to their Quick Check Terms and Conditions.

3.9.

Our customer panel

Our customer panel aims to improve our service and develop new features that are driven by our customers’ wants, needs and challenges. The customer panel is made up of existing customers only.

From time to time, we may ask you if you would like to join our customer panel to take part in customer research. Your participation on the customer panel will be governed by the Customer Panel Terms and Conditions. We’ll use any personal data you submit or give us access to in accordance with our Privacy Notice and any additional privacy notices associated with our customer panel or customer research.

3.10.

Open banking

If you choose to connect an account to your TotallyMoney account via our open banking partner Bud, we will use your open banking data to provide you with TotallyMoney services that are powered by open banking data.

For example, we will use your open banking data to:

see if you can reveal pre-approved offers for loans;

help you keep on top of your finances (e.g. see your balance after bills); and

give you access to new TotallyMoney open banking services that we develop in the future (but we will only use your open banking data for new services if your bank account is connected when the new service launches).

If you use our open banking service, you will be subject to Bud’s own user end user agreement, which can be found here.

We may refresh your open banking data up to four times a day while your account is connected. Your bank account will remain connected for 90 days. You can then choose to renew your connection or let it expire. You can disconnect your account at any time through your TotallyMoney account or your bank. Connecting your account will not affect your credit score or credit report in any way.

You can find out more about how we use your open banking data in our Privacy Notice.

4.

Soft searches and 'footprints' on your credit file

Some of our services involve soft searching your credit file. A soft search is like a quick peek at your credit file. Soft searches will not harm your credit rating or affect the way lenders see you.

TotallyMoney and its partners will soft search you while your account is live, to provide you with updates and personalised information and offers. For example, TotallyMoney and its partners will soft search your credit file with TransUnion and other credit reference agencies:

to calculate and update your Borrowing Power;

to create and update your free credit report, if you have one;

to match you with offers for which you are likely to be eligible; and

to analyse your financial situation, so that we can find other products and services you may be interested in.

You may see these soft searches as ‘footprints’ on your credit report in either our name or the name of one of the partners or credit reference agencies that we work with. Soft searches on your credit file will be given different markings, depending on their purpose, such as:

Affordability

Anti-Money Laundering

Consumer Credit File Request

Identity Check

Quotation/Preliminary Search

You may see multiple footprints on your credit file because soft searches may be carried out:

when you first sign up for our services;

when you log in;

when you go to the offers section of your account;

when you check or refresh your offers (e.g. when you click out on an email from us to ‘view offers’ or ‘find loans’) and;

in the background on at least once a month to refresh your Borrowing Power, credit report and credit score (we reserve the right to suspend these regular searches if your account has been inactive for a period of time).

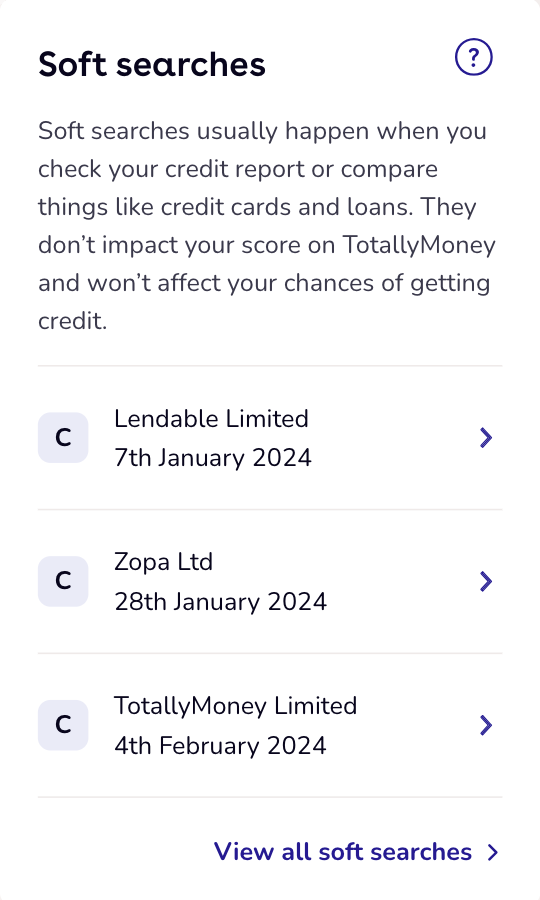

Here is an example of what footprints generated by our service might look like on your free credit report:

Soft searches are not the same as hard searches. Hard searches (also known as “full credit checks”) are recorded when you apply for credit and they are visible to other lenders. TotallyMoney does not initiate hard searches on your credit file because TotallyMoney is not a lender, though you can use our service to check whether you have any hard searches on your TransUnion credit report.

If we run a trial with a potential supplier and partner and we need to use real rather than dummy or anonymous data for the test to be effective you may see a footprint relating to that trial on your credit file.

See our Privacy Notice for more details.

5.

Using our services

5.1.

Acceptable use

By using our services, you confirm that:

you’re at least 18 years of age and resident in the United Kingdom;

you will only use our services and materials (e.g. content from our website, app or emails, referred to in these terms together as the “related materials”) in your own name, for personal and non-commercial purposes;

you won’t allow anyone else to use your account, either for their own purposes or on your behalf.

You may download or store the related materials on your device, but by doing so you acknowledge that downloading related materials removes the security protection afforded by the website and app, which may increase your risk of identity theft, fraud or other disclosure of your personal data. You may print a reasonable number of copies of the related materials for your own personal use.

You must not:

misuse the website or app by knowingly introducing viruses, trojans, worms, logic bombs or other material which is malicious or technologically harmful;

attempt to gain unauthorised access to the website or app, the server on which they are stored, or any server, computer or database connected to them;

harm the website or app by a denial-of-service attack or a distributed denial-of-service attack;

scrape, extract, download, upload, sell or offer for sale any of the website or app or the related materials;

use, or cause to be used, any computerized or other manual or automated program or mechanism, tool, or process, including any scraper or spider robot, to access, extract, download, scrape, data mine, display, transmit, or publish, any of the website or app or the related materials whether for commercial benefit or otherwise;

bypass robot exclusion headers or other similar measures that we may use to restrict access to, or caching of, the website or app or the related materials;

distribute, reproduce, modify, store, transfer or in any other way use any of the related materials (including as part of any database, information, archive, website or similar service) other than as set out above.

If you do any of these acts, you may commit a criminal offence. We’ll report any criminal acts to the relevant law enforcement authorities and we’ll co-operate with those authorities by disclosing your identity to them. If you do any of these acts, your right to use the website and app ceases immediately from the time of the relevant act.

5.2.

Ownership of our website, app and related materials

You acknowledge and agree that:

We or our licensors own all intellectual property and other proprietary rights in and to the website and app and the related materials; and

TransUnion and their licensors assert ownership of certain intellectual property rights in the credit report.

5.3.

Our right to use your information

When you use our services we need to use the information you provide to us on the website or app and information which is obtained in response to your use of the services so that we can provide, personalise and improve the website and app and the services. For more information about how we use your personal data, please see our Privacy Notice.

5.4.

Access to your account

You can access your account using your email address and password. You must not share your username or password with anybody else or let anybody else use your account.

You agree to:

keep your username and password secure;

be fully responsible for all use of the website or app using your username and password;

log out of your website and app account at the end of each session; and

let us know immediately if you suspect or become aware of anyone else using your username and password or any other breach of security, by emailing us [email protected].

You are responsible for:

setting up your device to access the website or app, including using your own virus protection software; and

ensuring that you comply with local laws if you choose to access the website or app from outside the United Kingdom.

5.5.

Availability

You acknowledge and agree that:

We may temporarily or permanently suspend your access to some, or all, of the website and/or app, the related materials and/or the services without notice;

We may update the website and/or app and the services made available through the website and/or app at any time in our sole discretion;

We try to make sure that the website and app are available 24 hours a day, but we don’t guarantee that they or any related materials will always be available or uninterrupted;

We accept no liability for any losses, damages or costs that arise from or relate to the website or app or any related materials being unavailable at any time or for any period; and

We don’t guarantee that the website or app or related materials will be free from bugs, viruses or malicious code.

5.6.

Third party content and links

We try to make sure that the content provided by our contracted third-party suppliers is accurate and complete. However, we can’t guarantee that it is completely accurate because some of this information comes from other businesses, which in turn get the information from other sources such as the electoral register, insurance companies or financial institutions. We and our contracted third-party suppliers are not liable for inaccuracies in the data provided to us by third parties.

Please note that we can’t correct information on your credit report. You can challenge incorrect information on your credit report using the “raise a dispute” function in your account. This will allow you to raise the dispute directly with TransUnion, who provide the credit report data.

Links on the website and app to third party websites and resources are provided solely for your information and convenience. By providing the links we don’t approve, endorse or make any representations about any such third-party websites or any material found on them or your use of that material. If you use these links, you leave the website and app. You access third-party websites and resources entirely at your own risk.

5.7.

Relying on information that we provide

Any information provided to you by us as part of the services is provided for guidance and information only. You should not rely on the information provided as part of services and neither we nor any credit reference agency (including in the case of the credit report service, TransUnion or any member of the TransUnion group of companies) are responsible or liable to you if you rely on it or take any action based upon it.

The fact that you have a good credit score does not mean that a partner will accept your application, and they have their own acceptance criteria and responsible lending policies.

5.8.

Third party products

We are not responsible for:

the products provided by third parties that are featured on our website or app (e.g. credit cards, loans, energy deals etc.); or

for any contract you enter into with a third party as a result of using the services.

If you have any problems with the products featured on our website or app, you should contact the product provider directly.

5.9.

Linking to our website or app

You may link to the website or app only with our express prior written consent. Please contact us if you would like to discuss this with us.

6.

General

6.1.

Limitations on liability

6.1.1. Disclaimer

We make no representations, warranties or guarantees, whether express or implied, that the website and app, the related materials or the services are accurate, complete or up to date or fit for your purpose. To the fullest extent permitted by law, we and the TotallyMoney group (by which we mean TotallyMoney Group Holdings Limited and its subsidiaries) expressly exclude all guarantees conditions, warranties, representations or other terms which might otherwise be implied by statute, common law or the law of equity to the website and app, the related materials and the services, whether express or implied.

6.1.2. Legal liabilities

Nothing in these terms excludes or limits the TotallyMoney group’s liability for: death or personal injury arising from our negligence; fraud or fraudulent misrepresentation; or any other liability that can’t be excluded or limited under applicable law.

6.1.3. Limited loss types

Subject to section 6.1.2. above, the TotallyMoney group shall not be liable to you or any third party for any loss or damage, however arising, whether in contract, tort (including negligence), breach of statutory duty, or otherwise, even if foreseeable, arising under or in connection with:

any defamatory, offensive or illegal conduct of any third party through the website or app or otherwise;

the website or app, the related materials or the services being unable to be used or unavailable for use for any reason;

any losses, damages or costs that arise from or relate to you failing to comply with the terms;

any loss or damage caused by a distributed denial-of-service attack, viruses or other technologically harmful material that may infect your computer equipment, computer programs, data or other proprietary material, due to your use of the website or app, downloading material from the website or app or visiting a website linked to the website or app;

any loss or damage whether direct or indirect for:

loss if income or revenue;

loss of business;

loss of profits or contracts;

loss of anticipated savings; or

loss of or damage to data.

6.1.4. Limited loss amounts

Subject to sections 6.1.2. and 6.1.3. above, as your access to the website and app and the services is free, the TotallyMoney group’s total aggregate liability for any losses and/or damage suffered by you that arise from or relate to your use of the website and app, the related materials and the services (whether in tort, contract or otherwise) will be limited to one hundred pounds Sterling (£100) unless otherwise agreed in writing by us.

6.1.5. Accepted loss types

Subject to sections 6.1.2., 6.1.3. and 6.1.4. above, the TotallyMoney group shall only be liable to you for your losses or damages caused by us or our employees or subcontractors in circumstances where there is a breach of a legal duty of care owed to you by us, our employees or subcontractors and that loss or damage was contemplated by you and us when you accepted these terms or is an obvious consequence of our breach of that duty, but we shall not be liable for any increase to your loss or damage arising from or relating to your actions.

6.2.

Duration of the services

6.2.1. Suspending your account

If we believe that:

you haven’t complied with any of these terms;

you are misusing any services (for example by using the credit report services in a way that isn’t permitted or that is fraudulent); or

that your use of the website or app is in any way detrimental to us or TransUnion; or

your use of the website or app is likely to be a security risk;

we may in our sole discretion suspend your access to the website and app or any part thereof without notice.

6.2.2. Terminating your account

At any time, with or without cause, we may terminate your agreement with us and your ability to use the website and app, the related materials or the services immediately by giving you written notice (including by email) to any of your contact addresses which you have provided to us. We may notify the credit reference agencies we work with if we terminate your agreement in this way.

6.2.3. End of use

You can stop using the website and app and the services at any time by closing your account. You can close your account by going to the “My Details” section of your account or by contacting us. If you do close your account, we can’t give you access to it again. If you stop using our credit report service you may not be able to create a new credit report service account with us, due to restrictions put in place by the credit reference agencies.

6.3.

Interpretation

In these terms:

the headings used don’t affect the interpretation of the terms;

unless specified otherwise, use of the singular includes the plural;

use of the words, includes or including means without limitation and the use of these words shall not limit the meaning of the general words.

6.4.

Validity

Each part of the provisions of these terms is severable. If any part of these terms is held to be invalid or unenforceable, that part shall be deemed modified to the minimum extent necessary to make it valid and enforceable and the remainder of these terms will remain valid and enforceable.

6.5.

Third parties

Save as expressly provided in these terms, nothing in these terms is intended to give any person any right to enforce any term of these terms which right would not exist without the Contracts (Rights of Third Parties) Act 1999.

6.6.

Control

We shall not be liable for any delay or failure to perform any of our obligations under these terms if the delay or failure is caused by circumstances beyond our reasonable control.

6.7.

Transfer

We may, but you may not, assign or otherwise transfer any of the respective rights or obligations of each of us under these terms.

6.8.

Waiver

No failure or delay by us to exercise any right provided to us in these terms or by law shall be a waiver by us of that or any other right, nor shall it restrict us from exercising that or any other right. No single or partial exercise of any right by us shall restrict the further exercise of that or any other right.

6.9.

Entire Agreement

These terms constitute the entire agreement and understanding between you and us in relation to their subject matter and your use of the website, the app and the services. Other than in circumstances of fraud, all previous agreements, undertakings, representations, warranties, promises and arrangements between you and us relating to the subject matter of these terms or your use of the website, the app or the services are superseded.

6.10.

Law

These terms and your use of the website and app, the related materials and the services are governed by and construed in accordance with the law of England and Wales. Any disputes (including non-contractual disputes or claims) will be decided only by the Courts of England and Wales.

7.

How to contact us

Your feedback helps us improve our services. Please let us know what we’re doing right, what needs improving, or if you have any questions. You can contact us at [email protected] or by clicking here. We also have a separate Complaints policy that is available here.

8.

Details of changes to these Terms

Version | Date | Details of Changes |

|---|---|---|

1.0 | 03/07/2017 | First published. |

1.1 | 14/08/2017 | References to Media Ingenuity Limited changed to TotallyMoney Limited to reflect name change of company number 06205695. |

1.2 | 16/08/2017 | Paragraph 3.6 amended to include links to the Experian and Callcredit terms applicable to data processed in connection with TotallyMoney services. |

1.3 | 02/10/2017 | Amendments to clarify that (a) lenders may inform us when a user is their existing customer; and (b) lender eligibility assessments may be carried out when a customer logs into their account. |

1.4 | 19/12/2017 | Paragraph 3.8 amended to refer to Capital One QuickCheck T&Cs. |

1.5 | 01/05/2018 | Amendments to reflect the closure of Intelligent Alerts Service as a standalone, non-account service, replaced by the Eligibility Check Service, which does not require registration. |

2.0 | 15/05/2018 | Updated to reflect requirements of the General Data Protection Regulation. |

2.1 | 15/01/2019 | Amended to reflect the requirement for new customers to register for TotallyMoney services, and to record the closure of the intelligent alerts service. |

2.2 | 22/04/2019 | Updated references to Callcredit to become references to TransUnion (Callcredit change of name). |

2.3 | 01/09/2019 | General update. Ts&Cs reworded to be clearer. |

3.0 | 16/12/2019 | Added/updated information about: energy comparison and switching service; specialist credit brokers that we work with; new credit report check (found/not found) on account sign up; footprints; change of name of TotallyMoney group parent company from UBIK Holdings Limited to TotallyMoney Group Holdings Limited |

3.1 | 28/01/2020 | Amended to reflect that TotallyMoney stopped providing eligibility checking services for customers of Credit Karma on 28 January 2020. |

3.2 | 01/06/2020 | Updated information on credit brokers that we work with in table in section 3.5.7. Updated list of footprints in section 4. Removed links to bespoke Credit Karma privacy notice and Ts&Cs (service discontinued 28 January 2020). |

3.3 | 27/07/2020 | Updated information on pre-approval in sections 3.5.3 and 3.5.8 to include details of responsible lending checks (including lender asking for consent to allow access to customer’s financial information via open banking integrations with the customer’s bank or building society). |

3.4 | 04/12/2020 | Adding references to push notifications. Adding references to new car insurance comparison service Updating list of brokers we work with Updating information on pre-approval (use of open banking data by partners) |

3.5 | 10/12/2020 | Updates to reflect new ‘live’ credit report service Updates to reflect changes to the way we calculate borrowing power. |

3.6 | 04/03/2021 | Adding reference to TransUnion fraud checks to section 3.4.3. Updating references to service emails in section 3.3 and 3.4.4. Adding new section 3.9, about our new customer panel. Updated section 3.4.2 to reflect Brexit (changed GDPR to UK GDPR) |

3.7 | 17/01/2022 | Removing references to card and loan approved products we no longer list these products) |

3.8 | 15/11/2022 | General updates to reflect updates to product and services. |

4.0 | 23/11/2022 | Updates to reflect launch of TotallyMoney open banking service (eligibility checking). |

4.1 | 30/11/2022 | Adding provisions relating to TotallyMoney debit card. |

4.2 | 15/05/2023 | General updates and adding infromation about new open banking services. |

4.3 | 27/10/2023 | Removing provisions relating to TotallyMoney debit card. |

4.4 | 20/02/2024 | Updates to clause 4 on soft searches. |

4.5 | 20/04/2024 | Updated to reflect change of address from Chapter House to White Collar Factory. |

4.6 | 30/05/2024 | Updated to reflect the credit report service. |

4.7 | 02/09/2024 | Updating list of brokers we work with. |

4.8 | 18/08/2025 | Updated to reflect additional financial crime measures. |